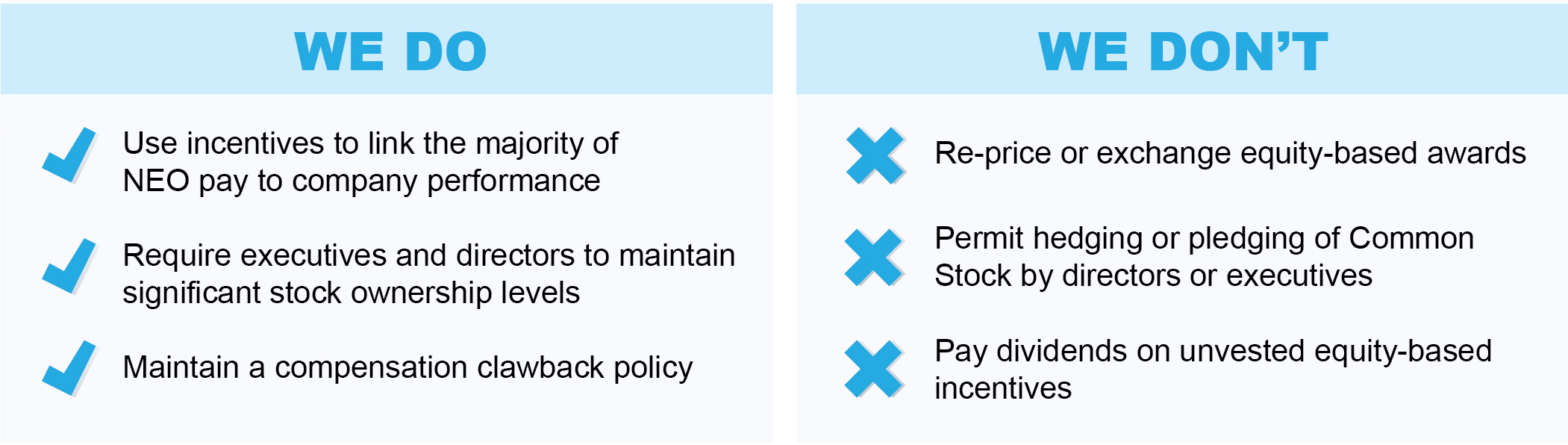

We continue to maintain best practices for executive compensationPROXY STATEMENT FOR 2023 ANNUAL MEETING. 43

Executive Compensation Program Overview

Guiding Principles

The Compensation Committee has identified the following guiding principles in overseeing the compensation program for our executives:

|

| | | | |

| | | |

Competitiveness Compensation programs should be designed to target at the 50thregressed 50th percentile plus or minus 15%, of total compensation for comparable executive positions at a customized peer group. | | Pay for Performance Where compensation for an executive is tied to the achievement of financial and strategic goals, actual results that exceed target levels should provide above-target payouts, and results that do not exceed threshold levels should not provide payouts. | |

| | | |

| | | |

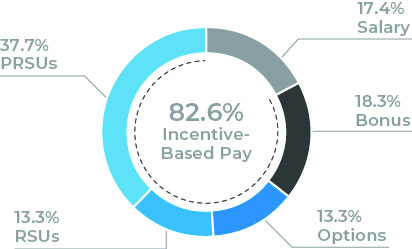

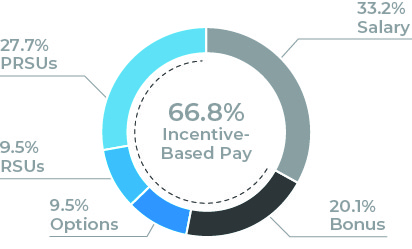

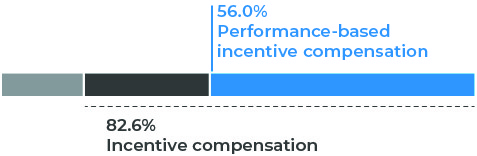

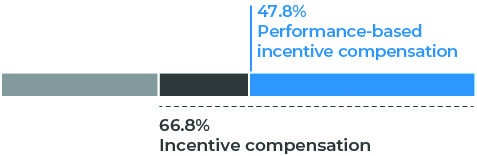

Responsibility A significant portion of an executive’s overall compensation should be tied to the achievement of financial performance goals. The portion of an executive’s target total compensation that is incentive based should increase as an executive’s responsibilities increase. | | Stockholder Alignment Executives’ interests are more directly aligned with stockholders’ interests when compensation programs: •Emphasize both short- and long-term financial performanceperformance; •Are significantly impacted by the value of Common StockStock; and •Require meaningful Common Stock ownership. | |

Peer Group Benchmarking and Total Compensation

Each year, the Compensation Committee’s compensation consultant collects peer group compensation data and prepares an executive benchmarking study using a market regression analysis to size-adjust the market data for our net sales size as a whole and for each separate business unit.whole. The Compensation Committee, with input from its independent compensation consultant, reviews the prior year peer group. This review focuses on companies that have a primary manufacturing component to their businesses, have similar organizational structures and are publicly traded or otherwise file financial statements with the SEC. The 20-companyWe believe the resulting peer group approved byprovides a valid and appropriate comparison for the Company’s executive compensation program and governance practices. For fiscal 2022, the Compensation Committee for fiscal 2017did not make any changes to the previous year’s group. (the “PeerThe peer group for fiscal 2022 (“Peer Group”) isconsisted of the companies listed below and is unchanged from the below.fiscal 2016 peer group.

|

| | | | | | | |

Fiscal 20172022 Peer Group |

Ametek, Inc. | IDEX CorporationThe Compensation Committee targets total compensation at or about the regressed 50th percentile of the Peer Group |

| Armstrong World Industries, Inc. | Lennox InternationalHelios Technologies, Inc. |

| Badger Meter, Inc. | Hillenbrand, Inc. |

| Chart Industries | IDEX Corporation |

| Circor International Inc. | Itron, Inc. |

| Crane Co. | Mueller Industries, Inc. |

Briggs & Stratton Corporation | Otter Tail Corporation |

Circor InternationalEnPro Industries, Inc. | Quanex Building Products Corporation |

Crane Co. | RoperESCO Technologies Inc. |

Curtiss-Wright Corporation | Tennant Co.SPX Flow |

Donaldson Company, Inc.Franklin Electric Co. | Valmont Industries, Inc. |

EnPro Industries,Graco Inc. | Watts Water Technologies, Inc. |

Graco Inc.Harsco Corp. | Worthington Industries, Inc.Zurn Elkay Water Solutions Corporation |

The Compensation Committee regularly reviews the target total compensation of each executive and compares it to the total compensation for comparable executive positions in the Peer Group. The Compensation Committee targets total compensation at or about the regressed 50th50th percentile of the Peer Group plus or minus 15% (“targeted 50th percentile range”), subject to individual adjustments based on experience, length of service, individual performance and other factors deemed appropriate by the Compensation Committee.

Compensation Elements

The following table lists our primary elements of compensation. Each element is targeted at or about the 50thregressed 50th percentile for comparable positions in the Peer Group.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Pay Element | Salary | Bonus | | | Options | RSUs | PRSUs |

| Recipients |

| | | | | |

Who Receives

| | | All NEOs ----------------------------------------------------------------------------------------------------------------------------------------> |

| | | | |

When Granted

|

|

|

|

|

|

| | | |

| Period of Grant | Generally reviewed every 12 months | Annually | | | Annually | Annually |

| | | | Annually |

| Form of Delivery | Cash ----------------------------------------------------------> | Equity ---------------------------------------------------------> |

| Cash | | | | | Equity | | |

| | | | | |

|

| Type of Performance |

| Short-term emphasis -------------------------------------> |

| | | | Long-term emphasis --------------------------------------> | |

|

| | | | |

Performance

Measures | — | Mix of financial results and EHS-related operational goals | | | Value of delivered shares based on stock price on date of exercise or lapse | Value of delivered shares based on stock price on vesting dates | Return on Net Assets ("RONA") achievement | Relative total shareholder return ("rTSR") |

| Performance Period / Vesting | Ongoing | 1 year | | | Generally vest annually over 3 years | VestsGenerally vest annually over 3 years | Measured and earned annually and vest at the end of the 3-year award cycles |

| cycle | | | | Vest at the end of the 3-year award cycle |

How Payout

Determined | Predominantly tied to Peer Group data, with an element of Compensation Committee discretion | Predominantly formulaic (based on performance against goals), with an element of Compensation Committee discretion | | | Completion of required service period through each vesting date | Completion of required service period through each vesting date | Formulaic (based on performance against goals); Compensation Committee verifies results |

| for specific performance periods | | | | |

Most Recent Performance Measures | __ | Mix of 90% financial results / 10% EHS-related operational goals | Value of delivered shares basedFormulaic (based on stock price on vesting dates | Improvement in return on net assetsperformance against peers) for specific performance periods |

Salary

The Compensation Committee regularly compares the salary of each executive to the regressed 50th50th percentile of comparable executives in the Peer Group and uses that benchmark as a guide. Salaries for the NEOs are adjusted, as appropriate, annually on February 1. In February 2017, Mr. Hart received an annual salary increase of 3.1%; Mr. Belknap received a salary increase of 3.0%; Mr. Rogowski received a salary increase of 3.0%; and Ms. Zakas received a salary increase of 4.4%. Ms. Zakas also received payments of $5,000 per monthThe Compensation Committee approved the following salaries for assuming interim human resources responsibilities.our NEOs in fiscal 2022. | | | | | | | | | | | | | | |

| Name | Annual Salary Rate at September 30, 2022 ($) | Annual Salary Rate at September 30, 2021 ($) | Salary Increase (%) |

| J. Scott Hall | 854,000 | | 825,000 | | 3.5 | |

| Marietta Edmunds Zakas | 454,564 | | 437,081 | | 4.0 | |

| Steven S. Heinrichs | 459,426 | | 443,890 | | 3.5 |

|

| Todd P. Helms | 372,203 | | 358,750 | | 3.7 | |

| Kenji Takeuchi | 374,920 | | 360,500 | | 4.0 | |

|

| | | | | | | | |

| Name | Annual Salary Rate at September 30, 2017 ($) | Annual Salary Rate at September 30, 2016 ($) |

| Gregory E. Hyland | 1,000,000 | | 900,000 | |

| Scott Hall | 750,000 | | N/A | |

| Evan L. Hart | 418,000 | | 405,300 | |

| Keith L. Belknap | 443,500 | | 430,500 | |

| Gregory E. Rogowski | 446,000 | | 433,000 | |

| Marietta Edmunds Zakas | 357,000 | | 341,900 | |

Annual Cash Incentive Awards

The annual cash incentive plan rewards our named executive officers for achieving key financial metrics, which drive our operating results and enhance stockholder value. The Compensation Committee targets annual cash incentive compensation for each executive at the regressed 50th50th percentile of comparable executives in the Peer Group. For fiscal 2017, the total target opportunity for each NEO was within the targeted 50th percentile range of the Peer Group. Based on actual achieved performance against performance goals, each NEO may earn between 0% and 200% of his or her annual cash target opportunity. For fiscal 2017, each NEO could earn an annual cash incentive award based on achievement against2022, the Compensation Committee selected two types of performance metrics: (i) financial performance goals (weighted 90%) and (ii) EHS-related operational goalsperformance metrics (weighted 10%). ForThe financial performance goals the Compensation Committee determined numeric goals targeting percentage improvements over the prior year’s results. All financial performance and EHS-related operational goals were set with minimum (or threshold), target and maximum objectives for each goal.related to

adjusted EBITDA, adjusted working capital (as a % of Contents

Fiscal 2017 Financialnet sales) and Operational Goals and Results

The Compensation Committee selected financial performance goals for corporate executives based on adjusted income from continuing operations. The Compensation Committee selected this metric to encourage focus on delivering income from continuing operations.

The Compensation Committee selected financial performance goals for Mr. Rogowski based on the Infrastructure segment’s adjusted operating income (defined as operating income, adjusted to exclude certain effects of results of operation’s of newly acquired businesses, pension settlement expenses and other charges), the Infrastructure segment’s adjusted net sales (adjusted to exclude Singer Valve) and adjusted income from continuing operations. The Compensation Committee selected a segment-specific financial performance goal for Mr. Belknap of improvement in adjusted operating income of Technologies and adjusted income from continuing operations.sales. The Compensation Committee selected these performance goals primarilyfinancial metrics to encourage our NEOs to focus on increasing adjusted operating income.

generating income from continuing operations and enhancing long-term stockholder value. The Compensation Committee established operational safety and environmental (“EHS”) objectives applicable to each NEO that wereEHS-related performance metric was tied to reductions in total recordable incidence rates and key performance indicators for sustainability and specific activities identified as leading safety indicators. The EHS objectives for Messrs. Hyland, Hall and Hart and Ms. Zakas were based on company-wide performance. The EHS objectives for Messrs. Rogowski and Belknap were based on Infrastructure and Technologies performance, respectively. The Compensation Committee used adjusted income from continuing operations to determineselected these metrics because they promote, drive and support the availability of a pool from which to pay the operationalCompany’s EHS objectives portion of the incentive award to Messrs. Hyland, Hall, Rogowskiinitiatives and Belknap.

The following table shows the fiscal 2017performance. All financial performance targets and actual results applicable to each NEO.

| Performance Targets and Results |

| | | | | | | | | | | |

| | | | Results Required to Achieve Bonus ($ in millions, except for percentages) | 2017

Actual

Results

($ in millions) | Actual 2017 Payout Factor (% of Target Bonus) unweighted |

| | | Weight (% of Target Bonus) |

| Name | Metric | Threshold (0%) | Target (100%) | Maximum (200%) |

| Gregory E. Hyland | Adjusted Income from Continuing Operations | 90 | 52.7 |

| 65.8 |

| 79.0 |

| 68.5 |

| 120.4 |

| | EHS | 10 | — |

| — |

| — |

| — |

| 128.3 |

| Scott Hall | Adjusted Income from Continuing Operations | 90 | 52.7 |

| 65.8 |

| 79.0 |

| 68.5 |

| 120.4 |

| | EHS | 10 | — |

| — |

| — |

| — |

| 128.3 |

| Evan L. Hart | Adjusted Income from Continuing Operations | 90 | 52.7 |

| 65.8 |

| 79.0 |

| 68.5 |

| 120.4 |

| | EHS | 10 | — |

| — |

| — |

| — |

| 128.3 |

| Keith L. Belknap | Adjusted Income from Continuing Operations | 55 | 52.7 |

| 65.8 |

| 79.0 |

| 68.5 |

| 120.4 |

| Technologies Adjusted Operating Income (Loss) | 35 | (5.0 | ) | 0 |

| 5.0 |

| (9.7 | ) | 0 |

| | EHS | 10 | — |

| — |

| — |

| — |

| 75.0 |

| Gregory S. Rogowski | Infrastructure Adjusted Operating Income | 40 | 138.4 |

| 173.0 |

| 207.6 |

| 166.2 |

| 80.2 |

Infrastructure Adjusted Net Sales | 25 | 715.7 |

| 753.0 |

| 790.6 |

| 729.6 |

| 37.1 |

| Adjusted Income from Continuing Operations | 25 | 52.7 |

| 65.8 |

| 79.0 |

| 68.5 |

| 120.4 |

| | EHS | 10 | — |

| — |

| — |

| — |

| 137.0 |

| Marietta Edmunds Zakas | Adjusted Income from Continuing Operations | 90 | 52.7 |

| 65.8 |

| 79.0 |

| 68.5 |

| 120.4 |

| | EHS | 10 | — |

| — |

| — |

| — |

| 128.3 |

Fiscal 2017 Annual Cash Incentive Awards

Fiscal 2017goals were set with minimum (or threshold), target and maximum objectives for each goal as described in the “Performance Targets and Results” table below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2022 ANNUAL PERFORMANCE TARGETS AND RESULTS |

| | | | | | | | | | |

| | Weighted Aggregate Actual % of Target for Ms. Zakas and Messrs. Hall, Heinrichs and Helms 89.3% |

| Metric | Weight (% of Target Bonus)( | | Results Required to Achieve Bonus ($ in millions, except for percentages)(1) | | Actual 2022 Payout Factor (% of Target Bonus) unweighted | |

| | |

Hall

Zakas

Heinrichs

Helms | Takeuchi | | Threshold

(50%) | Target

(100%) | Maximum

(200%) | | |

| Adjusted EBITDA | 50.0% | 45.0% | | | | 60.6% | |

| Net Sales | 25.0% | 20.0% | | | | 190.0% | |

| Adjusted Working Capital as a % of Net Sales | 15.0% | 15.0% | | | | 76.8% | | Weighted Aggregate Actual % of Target for Mr. Takeuchi 91.0% |

WMS Segment Net Sales(2) | — | 10.0% | | | | 142.0% | |

WMS Segment Adjusted EBITDA(2) | — | 10.0% | | | | —% | |

EHS(3) | 10.0% | — | | — | — | — | | —% | |

(1)See Exhibit A for a reconciliation of non-GAAP performance measures to GAAP performance measures.

(2)Applicable to only Mr. Takeuchi. “Segment Performance” includes (i) the Water Management Solutions (“WMS”) segment’s Net Sales and (ii) the WMS segment’s Adjusted EBITDA, each weighted 10% of Mr. Takeuchi’s total incentive target compensation.

(3)Applicable to Ms. Zakas and Messrs. Hall, Heinrichs and Helms.

FISCAL 2022 ANNUAL CASH INCENTIVE AWARDS

Based on actual performance against the performance goals as set forth above, each NEO earned 89.3% of his or her annual cash target opportunity for fiscal 2022 with the exception of Mr. Takeuchi, who earned 91.0%. The table below shows each NEO’s annual cash target opportunity and the amount of the annual cash bonuses paid to each NEO are set forth in the following table:NEO. | | | | | | | | | | | | | | | | | |

| At Target Performance |

| At Actual Performance |

| Name | % of Salary | Amount ($) | | % of Target | Amount ($) |

| J. Scott Hall | 105 | % | 886,438 | |

| 89.3 | % | 791,767 |

| Marietta Edmunds Zakas | 70 | % | 314,070 | |

| 89.3 | % | 280,528 |

| Steven S. Heinrichs | 60 | % | 272,515 | |

| 89.3 | % | 243,410 |

| Todd P. Helms | 60 | % | 220,602 | |

| 89.3 | % | 197,041 |

| Kenji Takeuchi | 50 | % | 185,031 | |

| 91.0 | % | 168,359 |

46 MUELLER WATER PRODUCTS, INC.

|

| | | | | | |

| Name | At Target Performance | At Actual Performance |

| % of Salary | Amount ($) | % of Target | Amount ($) |

Gregory E. Hyland(1) | 100 | 301,736 |

| 121.2 | 365,674 |

|

Scott Hall(1) | 100 | 750,000 |

| 121.2 | 908,925 |

|

| Evan L. Hart | 75 | 310,325 |

| 121.2 | 376,083 |

|

| Keith L. Belknap | 70 | 307,417 |

| 73.7 | 226,627 |

|

| Gregory E. Rogowski | 75 | 331,250 |

| 85.2 | 282,075 |

|

| Marietta Edmunds Zakas | 60 | 211,180 |

| 121.2 | 255,929 |

|

| |

(1) | Mr. Hyland’s 2017 bonus was based on his salary in effect, and performance achieved, during the period in which he served as President and Chief Executive Officer (from October 2016 through January 2017). Mr. Hall’s annual bonus for fiscal 2017 was not pro rated. |

Long-Term Equity-Based Compensation

For fiscal 2017, ourThe long-term incentive program included grantsaligns the interests of performance-based restrictedour NEOs with those of our stockholders and rewards our NEOs for achieving key metrics. This program drives operating results, enhances stockholder value and helps retain our NEOs. Due to the rules for how the grant date fair value of long-term incentive awards must be calculated for accounting purposes, the 2022 Summary Compensation Table may not reflect the same stock units (“PRSUs”)option and time-vested RSUs. ThePRSU values described below. In addition, accounting values can increase or decrease each year, causing volatility in the long-term incentive awards reported. For fiscal 2020 through fiscal 2022, the Compensation Committee targetsset each NEO’s target long-term compensation value for each NEO at or about the regressed 50th50th percentile of comparable executives in the Peer Group.

For fiscal 2017,2022 and fiscal 2021, the NEOs’ target long-term compensation value for each NEO was withinallocated 50% in the 50th percentile target rangeform of performance-based restricted stock units (“PRSUs”), 25% in the Peer Group.

Performance-Based Restricted Stock Unitsform of time-based stock options and 25% in the form of time-based restricted stock units (“RSUs”). The fiscal 2022 and fiscal 2021 PRSUs are based solely upon rTSR performance ("Market Units").

For fiscal 2017,2020, the NEOs’ target long-term compensation value was allocated 70% in the form of PRSUs and 30% in the form of RSUs. Fiscal 2020 PRSUs were divided into two categories, based upon applicable performance metric: (i) 57% of the PRSUs (and 40% of the total award) are based upon after-tax RONA achievement ("RONA Units") and (ii) 43% of the PRSUs (and 30% of the total award) are based solely upon rTSR performance, i.e., Market Units.

PERFORMANCE-BASED RESTRICTED STOCK UNITS

The following are the key aspects of the PRSUs awarded, granted, earned and/or vested in fiscal 2022 and fiscal 2021:

PRSUs Awarded for Fiscal 2022 and Fiscal 2021:

•For fiscal 2022 and fiscal 2021, 50% of each NEO’s target long-term incentive compensation value was awarded in the form of PRSUs. The key terms of the PRSUs are as follows:

Each PRSU award reflects a target number of shares (based onPRSUs awarded in fiscal 2022 and fiscal 2021 was equal to the fair markettarget value divided by the share price of our Common Stock on the award date)date of award.

•The fiscal 2022 and fiscal 2021 PRSUs are based solely upon the Company’s rTSR performance, i.e., Market Units.

•Market Units:

◦The relative total shareholder return or “rTSR” is measured by, during the applicable performance period, computing the total shareholder return of each company that may be issuedwas in the S&P 600 SmallCap Industrial Index at the beginning of the applicable performance period (the “TSR Group”) and comparing the Company’s total shareholder return results thereto in order to determine the quartile ranking within the TSR Group.

◦The Market Units consist of a single tranche and vest on a 3-year cumulative performance period against the applicable index.

◦The Compensation Committee establishes the performance period target related to the Market Unit award recipient aton the grant date of the award.

◦At the end of athe three-year award cycleperiod, the Compensation Committee confirms actual performance against the applicable performance target.

◦The number of shares of our Common Stock earned at the conclusion of each Market Unit performance period may range from zero to two times the number of target Market Units awarded, based on the level of achievement ofagainst the applicable performance targets.period target.

PRSUs Awarded for Fiscal 2020:

•For fiscal 2020, 70% of each NEO’s target long-term incentive compensation value was awarded in PRSUs. The number of PRSUs awarded in fiscal 2020 was equal to the target value divided by the share price of our Common Stock on the date of award. As noted above, the fiscal 2020 PRSUs comprise RONA Units and Market Units.

•Market Units: Market Unit details are described above for fiscal 2021 and fiscal 2022.

• RONA Units:

◦RONA Units are divided into three equal tranches and each tranche is measured and earned over successive one-year performance periods coinciding with our fiscal years.

PROXY STATEMENT FOR 2023 ANNUAL MEETING 47

◦The Compensation Committee establishes RONA Unit performance period targets for the then-current performance period on an annual basis.

◦At the end of each performance period, the Compensation Committee confirms actual performance against the applicable performance period target.

◦The number of shares of our Common Stock earned at the conclusion of each applicable RONA Unit performance period may range from zero to two times the number of target RONA Units in the applicable tranche, based on the level of achievement against the applicable annual performance target.

Each performance period target is established by the Compensation Committee on an annual basis coinciding with our fiscal year.target.

At the end of each fiscal year, the Compensation Committee confirms performance against the applicable performance target, and PRSUs◦RONA Units representing the level of achievement during thatthe specific performance period are “banked” for potential payout following the end of the three-year award cycle.

EarnedPRSUs Generally:

•All PRSUs are settled in shares of Common Stock. The actual number

•To receive earned shares of shares a participant may receive ranges from zero to two timesCommon Stock, the target numberNEO must be employed through the last day of shares, depending solely on the level of achievement during each performance period within thethree-year award cycle.

•PRSUs do not convey voting rightsrights or earn dividends.accrue dividends until vested.

Timeline for PRSU Grants |

| | | | | |

Grant | Fiscal 2015 | Fiscal 2016 | Fiscal 2017 | Fiscal 2018 | Fiscal 2019 |

Fiscal 2015 | Performance Period | Performance Period | Performance Period | | |

Fiscal 2016 | | Performance Period | Performance Period | Performance Period | |

Fiscal 2017 | | | Performance Period | Performance Period | Performance Period |

PERFORMANCE MEASURE AND RESULT FOR FISCAL 2022

Performance Measure and Result for Fiscal 2017

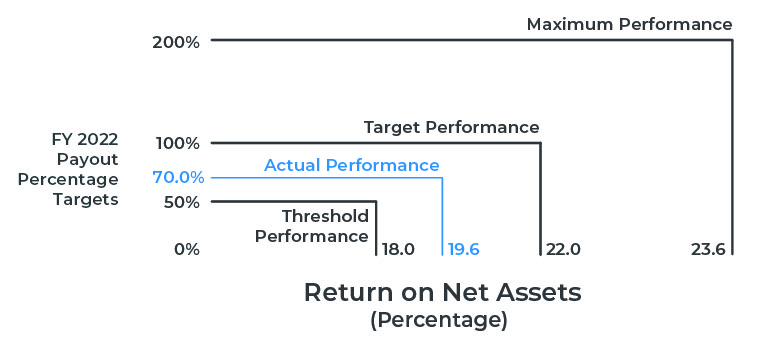

The applicable performance target for the fiscal 2017fiscal 2022 performance period for PRSUs awarded in fiscal 2020 was based partially on RONA and partially on rTSR. The applicable performance targets for the fiscal 2021 and fiscal 2022 performance periods for PRSU awards made in fiscal 2015, fiscal 20162021 and fiscal 2017 was2022, respectively, were based solely on the percentage year-over-year improvementrTSR. No RONA Units were awarded in return on net assets,fiscal 2021 or “RONA.” For these purposes, the termfiscal 2022. “RONA” hashas the meaning described in footnote 4 to the table under “— Highlights of 20172022 Performance Related to Executive Compensation”. Compensation.”

The Compensation Committee determined the RONA target using benchmark data from the Peer Group and assistance from the Company’s independent compensation consultant. For fiscal 2020, fiscal 2021 and fiscal 2022, the Compensation Committee established the RONA target at an absolute percentage on an after-tax basis. For fiscal 2022, the performance necessary to earn aat least 50% of RONA Unit target payout required a 1.16% year-over-year improvement in RONA of 18.0%, the performance necessary to earn 100% of RONA Unit target payout required RONA of 22.0%, and the performance necessary to earn athe maximum 200% of RONA Unit target payout required RONA of at least an 8.00% year-over-year improvement in RONA.23.6%. Actual RONA performance for fiscal 20172022 was 34.41%, compared to19.6%. Therefore, the 2022 performance period RONA of 34.01% for fiscal 2016, a 1.16% improvement. Accordingly, the recipients of PRSU awards were each credited with 100.0%Units will settle at 70.0% of the awards attributable to the fiscal 2017 performance period.awards. See “Executive Compensation — Grants of Plan-Based Awards Table”Table.”

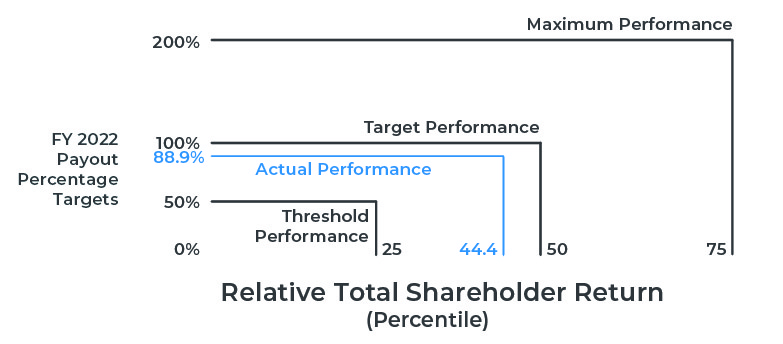

The Compensation Committee determined the rTSR target using benchmark data from the S&P 600 SmallCap Industrial Index (based upon a 20 trading day average) and assistance from the Company’s independent compensation consultant. For fiscal 2020, fiscal 2021 and fiscal 2022 grants, the performance necessary to earn 100% of Market Unit target payout requires the rTSR to be in the 50th percentile, and the performance necessary to earn the minimum of 50% and a maximum of 200% of Market Unit target payout requires the rTSR to be in the 25th and 75th percentile, respectively. The fiscal 2020, fiscal 2021 and fiscal 2022 Market Unit grants vest and settle at the end of the corresponding cumulative 3-year performance period. For the fiscal 2020 Market Unit grants, the performance during the actual performance period resulted in a Company rTSR in the 44.4% percentile, resulting in an achievement of 88.9%.

48 MUELLER WATER PRODUCTS, INC.

| | |

| PRSU PERFORMANCE MEASURES AND RESULTS FOR FISCAL 2022 |

|

|

PRSU Awards Issued

AWARD ISSUANCES

Common Stock to be issued related to PRSUs awarded in fiscal 20162021 (for the three-year award cycle from fiscal 20162021 through fiscal 2018)2023) and fiscal 20172022 (for the three-year award cycle from fiscal 20172022 through fiscal 2019)2024) will not be issued until the Compensation Committee certifiesconfirms performance results for the fiscal 20182023 and fiscal 20192024 performance periods.periods, respectively. Shares of Common Stock issued in December 2022 to NEOs for the PRSUs awarded in fiscal 20152020 (for the three-year award cycle from fiscal 20152020 through fiscal 2017)2022) and vested in fiscal 2022 are set forth in the following table:below:

| PRSU Settlements |

| | | | | |

| | Shares Earned | |

| Name | Fiscal 2015(1) (#) | Fiscal 2016(1) (#) | Fiscal 2017 (#) | Total Shares Issued (#) |

| Gregory E. Hyland | 0 | 34,798 | 34,083 | 68,881 |

|

| Evan L. Hart | 0 | 9,795 | 9,594 | 19,389 |

|

| Keith L. Belknap | 0 | 6,959 | 6,816 | 13,775 |

|

| Gregory E. Rogowski | 0 | 9,395 | 9,202 | 18,597 |

|

| Marietta Edmunds Zakas | 0 | 4,697 | 4,601 | 9,298 |

|

| | | | | | | | | | | | | | | | | |

(1)Year of Award | See the definitive proxy statements we filed with the SEC on January 15, 2016 and December 15, 2016, respectively, for information concerning target Performance Period |

| Fiscal 2020 | Fiscal 2021 | Fiscal 2022 | Fiscal 2023 | Fiscal 2024 |

| | | | | |

| Fiscal 2020 |

|

| Vested 2020 RONA performance and actual RONA performance for the 2015 and 2016 performance periods.UNIT Awards (3 Tranches) | |

|

| |

| | | |

| Vested 2020 Market Unit Awards

(1 Tranche) | | |

| | | | | |

| Fiscal 2021 |

| Future Vesting of 2021 Market Unit Awards

(1 Tranche) | |

| | | | | |

| Fiscal 2022 | | | Future Vesting of 2022 Market Unit Awards

(1 Tranche) |

| | | | | |

Time-Based Restricted Stock Units

As described above, a portion of an executive’s long-term incentive award value has historically beenPROXY STATEMENT FOR 2023 ANNUAL MEETING 49

| | | | | | | | | | | | | | |

| PRSU SETTLEMENTS OF FISCAL 2020 AWARD | | | | |

| | | | |

| Performance Periods | Total Issued Number of Shares |

| Fiscal 2020 | Fiscal 2021 | Fiscal 2022(1) |

| Name | Number of Shares Earned(2) |

| J. Scott Hall | 22,603 | 28,869 | 67,145 | 118,617 |

| Marietta Edmunds Zakas | 6,672 | 8,522 | 19,822 | 35,016 |

| Steven S. Heinrichs | 5,219 | 6,666 | 15,505 | 27,390 |

| Todd P. Helms | 2,099 | 4,462 | 9,355 | 15,916 |

| Kenji Takeuchi | 3,228 | 4,123 | 9,590 | 16,941 |

(1)Fiscal 2022 shares earned includes shares awarded inbased on RONA and rTSR.

(2)See the form of time-based RSUs. definitive proxy statements we filed with the SEC on December 21, 2020 and December 22, 2021, respectively, for information concerning target RONA performance and actual RONA performance for the fiscal 2020 and fiscal 2021 performance periods.

TIME-BASED RESTRICTED STOCK UNITS

For fiscal 2017, 50%2022, 25% of each NEO’s target long-term incentive compensation value was awarded in RSUs. The Compensation Committee approves a dollar value for these awards and its compensation consultant calculates the number of RSUs that equals thatawarded was equal to the compensation value baseddivided by the price of our Common Stock on the grant date stock price.of award. Typically, one-third of the RSUs grantedawarded vest on each anniversary of the grantaward date. See “Executive Compensation — Grants of Plan-Based Awards Table”.Table.”

TimingTIME-BASED STOCK OPTIONS

For fiscal 2022, 25% of each NEO’s target long-term incentive compensation value was awarded in stock options. The number of stock options awarded was equal to the compensation value divided by the grant date fair value of our Common Stock on the date of award. Typically, one-third of the stock options awarded vest on each anniversary of the award date. Due to the rules for how the grant date fair value of long-term incentive awards must be calculated for accounting purposes, the 2022 Summary Compensation Table may not reflect the same stock option values described above. In addition, accounting values can increase or decrease each year, causing volatility in the long-term incentive awards reported. The amounts reported in the Option Awards column in the 2022 Summary Compensation Table represent the grant date fair value of stock option awards granted under the Stock Plan to each of the NEOs, calculated in accordance with ASC Topic 718. We use a Black-Scholes model when determining the grant date fair value of stock options. For information on the assumptions used by us in calculating these values, see Note 12 to our consolidated financial statements in the Form 10-K. To see the value actually received upon exercise of options by the NEOs in fiscal 2022, refer to the 2022 Option Exercises and Stock Vested table in this Proxy Statement. Outstanding option awards are reflected in the 2022 Outstanding Equity Awards table in this Proxy Statement. Also see the “Executive Compensation — Grants of Plan-Based Awards Table” for additional information.

TIMING OF EQUITY AWARDS

While the Compensation Committee may grant equity-based awards at any of its scheduled meetings or by unanimous written consent, it generally grantsestablishes awards for executives at its November or December meeting each year, except for awards related to promotions or new hires. GrantsAwards approved during scheduled meetings become effective and are priced as of the date of approval or as of a pre-determinedpredetermined future date based on a date of hire. GrantsAwards approved by unanimous written consent become effective and are priced as of a pre-determinedpredetermined future date. All stock options have a per-share exercise price equal to the closing stock price on the NYSE on the effective date of the grant.award.

Other Cash and Equity Awards

Mr. Hall’s employment agreement provides for an initial long-term incentive opportunity valued at $1.5 million on the date of grant, comprised of (i) 50% in RSUs that vest ratably over three years and (ii) 50% in PRSUs vesting, to the extent earned, at the end of fiscal 2019. The awards for the fiscal 2017 performance period are not pro rated.None.

As an offset for forfeited performance and equity awards under Textron’s incentive plans, Mr. Hall was granted 56,069 RSUs, as determined in accordance with his employment agreement. These RSUs vest in full on the first anniversary of the commencement of Mr. Hall’s employment.

In May 2017, we entered into an agreement with Mr. Rogowski that will provide him with a lump sum payment of $550,000 in cash, provided he remains employed with the Company through February 16, 2020. The award is forfeited if, prior to such date, Mr. Rogowski’s employment is terminated by the Company with cause (as such term is defined in his employment agreement) or by Mr. Rogowski for any reason. If Mr. Rogowski’s employment is involuntarily terminated prior to such date by reason of death or disability, a pro rata portion of the cash award would be payable.

Retirement Benefits

We offer retirement benefits to our NEOs and other employees intended to provide a competitive source of retirement income. These retirement benefits are provided through the vehicles described below.

Retirement Savings Plan Applicable to Employees Generally50 MUELLER WATER PRODUCTS, INC.

RETIREMENT SAVINGS PLAN APPLICABLE TO EMPLOYEES GENERALLY

The Mueller Water Products, Inc.Group LLC Retirement Savings Plan is a 401(k) plan that provides retirement benefits for our non-union employees and those of our participatingparticipating subsidiaries. Each of our NEOs participated in the plan in fiscal 20172022 on the same basis as our other eligible employees.

Deferred Compensation Plan

Mr. Hyland is the only NEO who participates in a deferred compensation plan. He participates in an unfunded deferred compensation plan (the “Retirement Plan”), pursuant toemployees, under which we credited a bookkeeping account for him, commencing April16, 2007 and each calendar month thereafter through September16, 2010,make matching contributions in accordance with an amount equal to 10%the terms of his then current monthly base salary. The amounts credited to the plan bear interest at 120% of the long-term Applicable Federal Rate (as defined in the Code) until payment. At September30, 2017, $663,814 had been accrued and credited to Mr.Hyland’s deferral account. No further accruals will occur to the account, except for interest. Our fiscal 2017 interest accruals to the plan for Mr.Hyland were $19,754.that plan.

Upon termination of his employment with us, other than for cause, all deferred compensation under the Retirement Plan will be paid as a lump sum to Mr.Hyland.

Other Benefits

PerquisitesPERQUISITES

We provide certain perquisites to theour NEOs that the Compensation Committee believes are reasonable and consistent with itsour overall compensation program. In fiscal 2017,2022, the Compensation Committee offered the NEOs limited perquisites, including a car allowance,allowance (excluding Messrs. Helms and Takeuchi), life insurance, supplementalsupplemental long-term disability insurance and reimbursement for certain financial planning and annual physical examination expenses. See “Executive Compensation — Summary Compensation Table -— All Other Compensation”.Compensation.”

Severance BenefitsSEVERANCE BENEFITS

Each NEO is entitled to severance benefits. See “Executive Compensation — Potential Payments Upon Termination or Change-in-Control”.Change-in-Control.”

Change-in-Control AgreementsCHANGE-IN-CONTROL BENEFITS

Change-in-control agreements are used to create incentives for executives to build stockholder value and to seek the highest value possible for stockholders should we be acquired, despite the risk of losing employment. Our change-in-control agreements for executives provide for vesting of outstanding equity-based awards and payment of severance amounts upon a change-in-control and operate with a “double trigger”for severance payments and equity awards, meaning severance payments and accelerated vesting of equity awards do not occur unless the executive’s employment is involuntarily terminated (other than for causeCause or for termination for good reason)Good Reason as defined in the agreements) within 24 months following a change-in-control. The Compensation Committee believes this structure strikes an appropriate balance of incenting executives without providing benefits to executives who continue to enjoy employment with an acquiring company. The Compensation Committeeagreements also believes this structure is more attractive to potential acquiring companies that may place significant value on retaining members of our executive team and may perceive this objective to be undermined if executives receive significant severance payments solely

upon the closing of such a transaction. The agreements for Messrs. Rogowski and Hart and Ms. Zakas provide for an additional payment sufficient to eliminate the effect of any applicable excise tax on severance payments in excess of any amount determined under 280G of the Code. We would not be able to deduct payments subject to the excise tax for federal and state income tax purposes. The agreements for Messrs. Hall and Belknap contain a “best-of-net” provision, so that, in the event excise taxes would be imposed on payments under the agreements, the NEO will, at his or her discretion, either (1) pay the excise tax without assistance from the Company or (2) have the payments reduced to an amount at which an excise tax would no longer be payable, based on which resultpayable.

The Company provides NEOs without a change-in-control agreement with change-in-control benefits via the Company's executive severance plan approved by the Compensation Committee and instituted by the Company in January 2020. For applicable employees, the executive severance plan provides, upon a change-in-control, for vesting of outstanding equity-based awards if a replacement award (as defined in the executive severance plan) is more favorable tonot available and for payment of severance amounts if the NEO on an after-tax basis.executive’s employment is involuntarily terminated (other than for Cause or for termination for Good Reason as defined in the agreement) within 24 months following a change-in-control, i.e., a “double trigger.”

Employee Stock Purchase PlanEMPLOYEE STOCK PURCHASE PLAN

Our Employee Stock Purchase Plan (“ESPP”) provides all of our employees an opportunity to purchase Common Stock, subject to certain restrictions, through regular payroll deductions. During fiscal 2017, Messrs. Hart and Belknap were the only NEOs to participate in the ESPP.

Health and Welfare BenefitsHEALTH AND WELFARE BENEFITS

We generally offer group medical, dental, vision, life and long-term disability insurance in a flexible benefits package to all active U.S. employees, except as otherwise required by collective bargaining agreements. Employees are provided life insurance up to one times their base salaries at no charge, other than related income taxes, to the employee. For an additional charge, employees may obtain coverage of up to four times their base salary up to a maximum life insurance benefit of $1,250,000. NEOs participate on the same basis as other eligible employees.

PROXY STATEMENT FOR 2023 ANNUAL MEETING 51

Other Factors Considered by the Compensation Committee

Risk and Incentive Compensation

The Compensation Committee has conducted an assessment of our compensation policies and practices and does not believe these policies and practices are reasonably likely to have a material adverse effect on us. This assessment included a review of the risk profile of our compensation policies and practices for all employees. To facilitate its review, the Compensation Committee engaged its compensation consultant to review our compensation structure to identify design elements that might encourage excessive risk taking. The compensation consultant discussed its review and conclusions with the Compensation Committee. In conducting its review, the Compensation Committee noted several policies and practices that mitigate risk, including:

•Using multiple performance measures in annual incentive awards and capping payout levels;

•Maintaining the ability to reduce annual incentive awards, based on its independent judgment;

•Using multiple long-term incentive vehicles;

•Using overlapping multi-year award cycles in connection with performance shares and capping payout levels; and

•Maintaining stock ownership guidelines, an anti-hedging policy, an anti-pledging policy and a clawback policy.

Tally Sheets

The Compensation Committee regularly reviews “tally sheets” for each executive. The tally sheets contain information concerning prior years’ compensation, proposed compensation for the current year, outstanding equity-based awards (both vested and unvested) and various termination-of-employment scenarios. The tally sheets enableassist the Compensation Committee to view and evaluatein evaluating the many facets of executive compensation, understandunderstanding the magnitude of potential payouts as a result of termination-of-employment scenarios and considerconsidering changes to our compensation programs, arrangements and plans in light of emerging trends.

Wealth Accumulation Review

The Compensation Committee reviews “wealth accumulation” calculations, such as projections of how much stock an executive is projected to earn or accrue over time through cash and equity-based compensation or through certain benefits.

Other Compensation Practices and Policies

Role of Compensation Consultant in Compensation Decisions

The Compensation Committee has sole authority to select and retain a compensation consultant, including authority to approve fees and retention terms. For fiscal 2017,2022, the Compensation Committee retained Meridian Compensation Partners,Farient Advisors, LLC as its compensation consultant. The Compensation Committee reviews the performance of its compensation consultant annually.

In fiscal 2017,2022, the compensation consultant’s responsibilities included, but were not limited to:

•Providing recommendations regarding the composition of our Peer Group;

•Preparing and analyzing Peer Group compensation and plan design data;

•Reviewing and advising on the performance measures to be used in incentive awards;

•Valuing equity-based awards; and

•Reviewing and advising on principal aspects of executive and non-employee director compensation, including base salaries, bonuses, perquisites and equity-based awards for executives, and cash compensation and equity-based awards for non-employee directors.

The Compensation Committee considered the independence of its compensation consultant in light of standards under the NYSE Manual.listing standards. The Compensation Committee requested and received a letter from the compensation consultant addressing its independence, including the factors described below:

•Other services provided to us by the consultant;

•Fees paid by us as a percentage of the consultant’s total revenue;

•Policies or procedures maintained by the consultant that are designed to prevent a conflict of interest;

•Any business or personal relationships between the individual consultants involved in the engagement and a member of the Compensation Committee;

•Any Common Stock owned by the individual consultants involved in the engagement; and

52 MUELLER WATER PRODUCTS, INC.

•Any business or personal relationships between our executives and the consultant or the individual consultants involved in the engagement.

The Compensation Committee took into account these considerations, along with other factors relevant to the compensation consultant’s independence from management, and concluded the compensation consultant is independent and the engagement of the compensation consultant and the services rendered by the compensation consultant did not raise any conflict of interest.

Role of Management in Compensation Decisions

The Compensation Committee reviews information provided by its compensation consultant and uses that information as a reference point for the components of compensation. The Compensation Committee and the Chief Executive Officer discuss the financial metrics and operational goals intended to closely align performance targets of the business units and the Company as a whole with our strategic goals. The Chief Executive Officer makes recommendations to the Compensation Committee for executives other than himself with respect to annual salary adjustments, annual incentive adjustments and grants of equity-based awards under our incentive plans. The Compensation Committee makes the final decision with respect to the compensation of these executives, taking into consideration the Chief Executive Officer’s recommendations.

The Compensation Committee annually receives input from the entire Board with respect to the Chief Executive Officer’s performance and recommends his compensation level to the Board. The Board discusses and approves the annual salary of the Chief Executive Officer. The Chair of the Compensation Committee and another Compensation Committee member designated byNon-Executive Chair of the ChairBoard meet with the Chief Executive Officer to discuss the Chief Executive Officer’s performance and compensation based on evaluations received from the Board. These discussions are considered by the Compensation Committee in setting all elements of compensation for the Chief Executive Officer.

In fiscal 2017,2022, the Chief Executive Officer was present at all of the Compensation Committee meetings but was excused from the executive sessions of the Compensation Committee and did not participate in meetings or deliberations during which his compensation was discussed.

Income Tax Consequences of Executive Compensation

Our compensation programs were designed to permit us to deduct compensation expense under Section 162(m) of the Internal Revenue Code, which historically limited the tax deductibility of annual compensation paid to executives to $1 million, unless the compensation qualified as “performance-based.” The exemption from Section 162(m)’s deduction limit for performance-based compensation has been repealed (subject to certain transition rules), effective for taxable years beginning after December 31, 2017, such that compensation paid to our NEOs in excess of $1 million is generally deniesnot deductible. As a corporate taxresult, we may no longer take a deduction for annualany compensation exceeding $1 million paid to our NEOs (other thanin excess of $1 million. In fiscal 2022 and in plans for fiscal 2023, the CFO). The limitation does not applyCompensation Committee continued to design compensation based on achievementprograms and make grants that it believes are performance-based and well aligned with the interests of pre-established performance goals if certain requirements are met. The 2006our stockholders.

Previous grants made under the Stock Plan, and the PRSUs granted thereunder, as well as the annual cash incentive award, arewere structured and were intended to permit such awards to qualify as performance-based“performance-based” compensation to maximize the tax deductibility of these awards. Theseawards under Section 162(m). Those awards may not be fully deductible under all circumstances, as a number of additional requirements must be met for the awards to qualify as performance-based“performance-based” compensation. In addition, the Compensation Committee believes stockholder interests are best served by not restricting its discretion and flexibility in structuring compensation programs, even though such programs may result in certain non-deductible compensation expenses, and therefore, it reserves the discretion to award compensation that is not exempt from the deduction limits of Section 162(m).

Compensation Recovery (Clawback) Policy

Our employment agreements contain a provision requiring the employee,NEOs are required, to the extent required by law, to reimburse us following the publication of a restatement of our financial statements due to material noncompliance with any financial reporting requirement under the securities laws as a result of misconduct for (a)incentive-based or equity-based compensation received and (b)any profits realized from the sale of our securities in each case during the 12 months prior to discovery of the noncompliance. The Compensation Committee has exclusive authority to interpret and enforce this provision.

The Compensation Committee has adopted a “Clawback Policy” to recover pay that is determined to have been wrongfully earned by managerial or executive employees, including our NEOs. As a result, all RSUsequity awards granted after November 30, 2009 include a clause that reduces the number of equity-based awards upon the occurrence of certain events. The Compensation Committee has the exclusive authority to interpret the Clawback Policy and may offset compensation as necessary to recover amounts due under the Clawback Policy.

PROXY STATEMENT FOR 2023 ANNUAL MEETING 53

Prohibition on Hedging and Pledging

We do not allow directors or employees to hedge the value of our equity securities held directly or indirectly by them. Our policy prohibits the purchase or sale of puts, calls, options or other derivative securities based on our securities, as well as hedging or monetization transactions, purchases of our equity securities on margin and borrowing against any account in which our securities are held. We prohibit pledging of Common Stock by executives or directors.

Stock Ownership Guidelines

The Compensation Committee has adopted stock ownership guidelines to promote a high level of stock retention among executives and non-employee directors. The guidelines require that the total value of the executive’s or non-employee director’s holdings of Common Stock must equal or exceed the specified target value shown below.

|

| | | | | | | |

| Position/Title | | Target Ownership |

| Chief Executive Officer and President | | 6 x6x base salary |

| Executive Vice Presidents | | 3 x 3xbase salary |

| Senior Vice Presidents | | 2 x2x base salary |

| Vice Presidents | | 1x base salary |

| Non-Employee Directors | | 5 x5x annual retainer |

Participants have five (5) years from the date a participant becomes subject to the program to achieve the applicable stock ownership target. If a participating individual is promoted, the promoted participant has three (3) years from the date of promotion to increase his or her holdings to meet the applicable stock ownership requirements. All NEOs and directors are in compliance with our stock ownership requirements.guidelines. Our stock ownership guidelines are available on our website. Seewebsite at www.muellerwaterproducts.com.

Report of the Guidelines for more detail.

REPORT OF THE COMPENSATION AND HUMAN RESOURCES COMMITTEECompensation and Human Resources Committee

The Compensation Committee participated in the preparation of the Compensation Discussion and Analysis. Based on its review and discussions with management, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in this Proxy Statement.

See “Corporate Governance— Board Operations“Board Structure — Board Committee Information” for information concerning the Compensation Committee and its responsibilities.

| | | | | |

|

| Compensation and Human Resources Committee |

Michael | MICHAEL T. Tokarz, ChairmanTOKARZ, CHAIR |

Shirley | SHIRLEY C. FranklinFRANKLIN |

Jerry W. Kolb | THOMAS J. HANSEN |

| JEFFERY S. SHARRITTS |

| STEPHEN C. VAN ARSDELL |

Executive Compensation Tables Summary Compensation Table

The amounts reported in the following table, including base salary, annual and long-term incentive amounts, benefits and perquisites, are described more fully under “Compensation Discussion and Analysis”.Analysis.”

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | Fiscal

Year | Salary(1) ($) | Bonus

($) | Stock Awards(2) ($) | Option Awards(3) ($) | Non-Equity Incentive Plan Compensation(4) ($) | All Other Compensation(5) ($) | Total

($) |

J. Scott Hall President and Chief Executive Officer | 2022 | 844,227 | — | 2,470,487 | 643,742 | 791,767 | 56,873 | 4,807,096 |

| 2021 | 821,821 | — | 2,910,266 | 540,491 | 1,223,178 | 53,275 | 5,549,031 |

| 2020 | 777,786 | — | 2,509,534 | — | 946,456 | 52,990 | 4,286,766 |

Marietta Edmunds Zakas Executive Vice President and Chief Financial Officer | 2022 | 448,672 | — | 642,729 | 163,879 | 280,528 | 54,270 | 1,590,078 |

| 2021 | 432,791 | — | 816,844 | 147,965 | 443,070 | 46,968 | 1,887,638 |

| 2020 | 404,692 | — | 755,866 | — | 344,717 | 49,395 | 1,554,671 |

Steven S. Heinrichs Executive Vice President, Chief Legal and Compliance Officer and Secretary | 2022 | 454,191 | — | 502,452 | 128,111 | 243,410 | 46,322 | 1,374,485 |

| 2021 | 440,241 | — | 642,337 | 116,232 | 386,312 | 43,816 | 1,628,938 |

| 2020 | 413,001 | — | 521,697 | — | 301,538 | 36,975 | 1,273,211 |

Todd P. Helms Senior Vice President and Chief Human Resources Officer | 2022 | 367,670 | — | 349,316 | 89,677 | 197,041 | 29,505 | 1,033,209 |

| 2021 | 355,801 | — | 360,161 | 81,362 | 312,216 | 31,484 | 1,141,023 |

| 2020 | — | — | — | — | — | — | — |

Kenji Takeuchi Senior Vice President, Water Management Solutions | 2022 | 370,061 | — | 346,808 | 90,120 | 168,359 | 19,507 | 994,855 |

| 2021 | 356,962 | — | 311,731 | 69,732 | 234,925 | 19,466 | 992,816 |

| 2020 | — | — | — | — | — | — | — |

|

| | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position(1) | Fiscal Year | Salary(2) ($) | Bonus(3) ($) | Stock Awards(4) ($) | Non-Equity Incentive Plan Compensation(5) ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings(6) ($) | All Other Compensation(7) ($) | Total ($) |

Gregory E. Hyland Executive Chairman, Former President and Chief Executive Officer | 2017 | | 968,403 |

| — |

| | 2,256,468 |

| | 365,674 |

| | 19,754 |

| | 49,624 |

| | 3,659,923 |

|

| 2016 | | 900,000 |

| 27,000 |

| | 2,020,011 |

| | 1,160,658 |

| | 17,669 |

| | 53,791 |

| | 4,179,129 |

|

| 2015 | | 900,000 |

| 27,000 |

| | 2,248,099 |

| | 280,485 |

| | 19,044 |

| | 51,122 |

| | 3,525,750 |

|

Scott Hall President and Chief Executive Officer | 2017 | | 518,229 |

| — |

| | 1,657,694 |

| | 908,925 |

| | — |

| | 108,195 |

| | 3,193,043 |

|

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Evan L. Hart Senior Vice President and Chief Financial Officer | 2017 | | 413,767 |

| — |

| | 641,505 |

| | 376,083 |

| | — |

| | 32,035 |

| | 1,463,390 |

|

| 2016 | | 401,367 |

| — |

| | 573,278 |

| | 388,208 |

| | — |

| | 31,801 |

| | 1,394,654 |

|

| 2015 | | 389,673 |

| — |

| | 652,443 |

| | 96,560 |

| | — |

| | 31,769 |

| | 1,170,445 |

|

Keith L. Belknap Executive Vice President, Business Development, General Counsel and Chief Compliance Officer | 2017 | | 439,167 |

| — |

| | 541,499 |

| | 226,627 |

| | — |

| | 40,295 |

| | 1,247,588 |

|

| 2016 | | 427,000 |

| — |

| | 470,670 |

| | 302,454 |

| | — |

| | 37,198 |

| | 1,237,322 |

|

| 2015 | | 385,760 |

| — |

| | 703,181 |

| | 89,218 |

| | — |

| | 38,787 |

| | 1,216,946 |

|

Gregory S. Rogowski Executive Vice President, Sales and Marketing | 2017 | | 441,667 |

| — |

| | 632,914 |

| | 282,075 |

| | — |

| | 37,372 |

| | 1,394,028 |

|

| 2016 | | 429,500 |

| — |

| | 552,069 |

| | 389,614 |

| | — |

| | 37,226 |

| | 1,408,409 |

|

| 2015 | | 418,382 |

| — |

| | 631,719 |

| | 196,283 |

| | — |

| | 34,005 |

| | 1,280,389 |

|

| Marietta Edmunds Zakas | 2017 | | 351,967 |

| 60,000 |

| | 393,623 |

| | 255,929 |

| | — |

| | 36,883 |

| | 1,098,402 |

|

| Executive Vice President, Strategy, Corporate Development and Communications | 2016 | | 338,567 |

| 145,000 |

| | 271,111 |

| | 261,973 |

| | — |

| | 36,612 |

| | 1,053,263 |

|

| | |

|

|

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| |

(1) | Effective January 23, 2017, Scott Hall was appointed President and Chief Executive Officer. Mr. Hall succeeded Gregory Hyland, Executive Chairman. |

| |

(2) | Mr. Hyland served as our President and Chief Executive Officer until January 23, 2017. Mr Hyland’s annualized salary was $900,000 during the period of October 1, 2016 through January 31, 2017, and $1,000,000 during the period of February 1, 2017 through September 30, 2017. |

| |

(3) | Payments made to Ms. Zakas were in recognition of assuming interim Human Resources responsibilities. See “Compensation Discussion and Analysis — Compensation Elements — Salary”. |

| |

(4) | The dollar amounts shown for RSU and PRSU awards represent the aggregate grant date fair values calculated in accordance with ASC 718, Stock Compensation, excluding the effect of forfeitures. See “Compensation Discussion and Analysis — Compensation Elements — Long-Term Equity-Based Compensation” for more information. The dollar amounts shown for fiscal 2017 include the aggregate grant date fair values of PRSUs awarded in fiscal 2015, 2016 and 2017 for the fiscal 2017 performance period assuming target performance. Assuming maximum performance, the aggregate values of PRSUs awarded for the fiscal 2017 performance period would have been: $500,016 for Mr. Hall; $2,512,956 for Mr. Hyland; $713,017 for Mr. Hart; $583,016 for Mr. Belknap; $387,272 for Ms. Zakas; and $693,842 for Mr. Rogowski. Estimated amounts that may be earned over the entire three-year award cycle of outstanding PRSUs are reflected in “Outstanding(2)“Stock Awards” comprise RSUs, Market Units and RONA Units. All RSUs and Market Units are granted on the date of award. RONA Units are granted annually in three equal tranches, beginning on the date of award. For fiscal 2022, the Stock Awards amounts include the aggregate grant date fair values of RSUs and Market Units granted in fiscal 2022 and the third tranche of RONA Units awarded in fiscal 2020 for the fiscal 2022 performance period. The dollar amounts shown for Stock Awards represent the aggregate grant date fair values calculated in accordance with ASC 718, Stock Compensation. See “Compensation Discussion and Analysis — Compensation Elements — Long-Term Equity-Based Compensation” for more information. The grant date fair value of the fiscal 2020, fiscal 2021 and fiscal 2022 Market Units was $14.94, $15.39 and $15.76, respectively. (3)“Option Awards” comprise stock options. All stock amounts for the awards represent the grant date fair value of stock options granted under the Stock Plan to each of the NEOs, calculated in accordance with ASC Topic 718. For more information regarding how the Company calculated these amounts, see the audited financial statements contained in our fiscal 2022 Form 10-K. The calculated compensation expense of the option awards recognized for financial reporting purposes will vary from the actual amount ultimately realized by the NEOs due to stock price fluctuations and timing factors related to the NEO’s realization of value from the option. To see the value actually received upon exercise of options by the NEOs in 2022, refer to the 2022 Option Exercises and Stock Vested table. Additional information on all outstanding option awards is reflected in the 2022 Outstanding Equity Awards table and the Grant of Plan-Based Awards Table” below. The dollar amount shown for Mr. Hall includes stock awards made to Mr. Hall as an offset for forfeited performance and equity awards under his prior employer’s incentive plans. See “Compensation Discussion and Analysis — Compensation Elements — Other Cash and Equity Awards” for more information. |

| |

(5) | Amounts reflect annual non-equity incentive plan compensation awards earned by our NEOs based on Company and segment financial performance and EHS-related objectives. The amounts earned for fiscal 2017 were paid in December 2017. See “Compensation Discussion and Analysis — Compensation Elements — Annual Cash Incentive Awards” for more information. |

| |

(6) | Amounts reflect accruals for deferred compensation for Mr. Hyland under a plan we established for his benefit. See “— Nonqualified Deferred Compensation During Fiscal Year 2017” below. |

| |

(7) | Amounts reflect the combined value of each NEO’s perquisites and compensation that is not otherwise reflected in the Summary Compensation Table. Amounts for fiscal 2017 are described in “— All Other Compensation” below. |

Table of Contentsthis Proxy Statement. See “Compensation Discussion and Analysis — Compensation Elements — Long-Term Equity-Based Compensation” for more information. The grant date fair value of the fiscal 2021 and fiscal 2022 stock options was $3.05 and $3.43, respectively.

(4)Amounts reflect annual non-equity incentive plan compensation awards earned by our NEOs based on Company financial performance along with and EHS-related objectives and segment performance, as applicable. The amounts earned for fiscal 2022 were paid in December 2022. See “Compensation Discussion and Analysis — Compensation Elements — Annual Cash Incentive Awards” for more information.

(5)Amounts reflect the combined value of each NEO’s perquisites and compensation that is not otherwise reflected in the Summary Compensation Table. Amounts for fiscal 2022 are described in “— Summary Compensation Table — All Other Compensation” below.

PROXY STATEMENT FOR 2023 ANNUAL MEETING 55

Summary Compensation Table - All Other Compensation

The following table provides additional detail regarding the amounts presented in the “All Other Compensation” column in the Summary Compensation Table for fiscal 2022.

| | | | | | | | | | | | | | | | | | | | |

| Name | Vehicle

Allowance

($) | Financial Planning(1) ($) | Contributions

to 401(k)

Plans

($) | Life and

Long-Term

Disability

Insurance

($) | Other(2) ($) | Total

($) |

| J. Scott Hall | 24,000 | | — | | 15,250 | | 17,623 | | | 56,873 | |

| Marietta Edmunds Zakas | 18,000 | | 7,500 | | 15,079 | | 10,341 | | 3,350 | | 54,270 | |

| Steven S. Heinrichs | 18,000 | | 1,320 | | 15,250 | | 8,591 | | 3,161 | | 46,322 | |

| Todd P. Helms | — | | 7,500 | | 14,835 | | 7,170 | | — | | 29,505 | |

| Kenji Takeuchi | — | | — | | 14,874 | | 4,633 | | | 19,507 | |

(1)2017NEOs are entitled to reimbursement of up to $7,500 for annual financial planning ($10,000 for the CEO).

(2)Other compensation for Ms. Zakas and Mr. Heinrichs consists of reimbursement of annual physical exam expenses. See “Compensation Discussion and Analysis — Compensation Elements — Other Cash and Equity Awards.”

|

| | | | | | | | | | | | |

| Name | Vehicle Allowance or Use of Leased Vehicle ($) | Financial Planning (1) ($) | Contributions to 401(k) Plans ($) | Life and Long-Term Disability Insurance ($) | Other(2) ($) | Total ($) |

| Gregory E. Hyland | 14,000 |

| 2,825 |

| 10,800 |

| 18,999 |

| 3,000 | 49,624 |

|

| Scott Hall | 17,000 |

| — |

| 10,800 |

| 3,739 |

| 76,656 | 108,195 |

|

| Evan L. Hart | 18,000 |

| — |

| 10,800 |

| 3,235 |

| — | 32,035 |

|

| Keith L. Belknap | 18,000 |

| 2,100 |

| 10,800 |

| 6,395 |

| 3,000 | 40,295 |

|

| Gregory S. Rogowski | 18,000 |

| — |

| 10,800 |

| 5,524 |

| 3,048 | 37,372 |

|

| Marietta Edmunds Zakas | 14,400 |

| 7,500 |

| 10,800 |

| 4,183 |

| — | 36,883 |

|

| |

(1)

| NEOs are entitled to reimbursement of up to $7,500 of annual financial planning ($10,000 for the CEO). |

| |

(2) | For Messrs. Hyland and Belknap, represents reimbursement of annual physical exam expenses. For Mr. Hall, represents relocation reimbursements and expenses. For Mr. Rogowski, represents the incremental cost to us of his spouse accompanying him on a sales incentive trip. |

Grants of Plan-Based Awards Table

The following table summarizes the equity awardsfiscal 2022 grants made to our NEOs during fiscal 2017on November 30, 2021 on a grant-by-grant basis. Each of the equity-based awards granted during fiscal 20172022 and reported in the following table was granted under, and is subject to the terms of, the 2006 Stock Plan. |

| | | | | | | | | | | | | | | | | |

| Fiscal 2017 Grants of Plan-Based Awards Table |

| | | | Estimated Possible Payouts Under Non-Equity Incentive Plan Awards (1) | Estimated Future Issuance of Shares Under Equity Incentive Plans (2) | All Other Stock-Based Awards (#) (3) | Grant Date Fair Value of Stock-Based Awards ($) (4) |

| Name | Grant Date | | Threshold ($) | Target ($) | Maximum ($) | Threshold (#) | Target (#) | Maximum (#) |

| Gregory E. Hyland | | | — | 301,736 |

| 603,472 |

| | | | | |

| | 11/29/2016 | | | | | | | | 75,414 |

| 999,990 |

|

| | 11/29/2016 | (5) | | | | 12,569 |

| 25,138 |

| 50,276 |

| | 333,330 |

|

| | 12/1/2015 | (5) | | | | 17,768 |

| 35,536 |

| 71,072 |

| | 471,207 |

|

| | 12/2/2014 | (5) | | | | 17,041 |

| 34,083 |

| 68,166 |

| | 451,941 |

|

| Scott Hall | | | — | 750,000 |

| 1,500,000 |

| | | | | |

| | 3/29/2017 | | | | | | | | 56,069 |

| 657,689 |

|

| | 1/23/2017 | | | | | | | | 57,034 |

| 749,997 |

|

| | 1/23/2017 | (5) | | | | 9,506 |

| 19,012 |

| 38,024 |

| | 250,008 |

|

| Evan L. Hart |

| | — | 310,325 |

| 620,650 |

| | | | | |

| | 11/29/2016 | | | | | | | | 21,493 |

| 284,997 |

|

| | 11/29/2016 | (5) | | | | 3,582 |

| 7,164 |

| 14,328 |

| | 94,995 |

|

| | 12/1/2015 | (5) | | | | 5,064 |

| 10,128 |

| 20,256 |

| | 134,297 |

|

| | 12/2/2014 | (5) | | | | 4,797 |

| 9,594 |

| 19,188 |

| | 127,216 |

|

| Keith L. Belknap |

| | — | 307,417 |

| 614,834 |

| | | | | |

| | 11/29/2016 | | | | | | | | 18,853 |

| 249,991 |

|

| | 11/29/2016 | (5) | | | | 3,142 |

| 6,284 |

| 12,568 |

| | 83,326 |

|

| | 12/1/2015 | (5) | | | | 4,442 |

| 8,884 |

| 17,768 |

| | 117,802 |

|

| | 12/2/2014 | (5) | | | | 3,408 |

| 6,816 |

| 13,632 |

| | 90,380 |

|

| Gregory S. Rogowski |

| | — | 331,250 |

| 662,500 |

| | | | | |

| | 11/29/2016 | | | | | | | | 21,568 |

| 285,992 |

|

| | 11/29/2016 | (5) | | | | 3,594 |

| 7,189 |

| 14,378 |

| | 95,326 |

|

| | 12/1/2015 | (5) | | | | 4,886 |

| 9,772 |

| 19,544 |

| | 129,577 |

|

| | 12/2/2014 | (5) | | | | 4,601 |

| 9,202 |

| 18,404 |

| | 122,019 |

|

| Marietta Edmunds Zakas |

| | — | 211,180 |

| 422,360 |

|

|

|

|

|

|

| |

|

|

| | 11/29/2016 | |

|

|

|

|

| | | | 15,082 |

| 199,987 |

|

| | 11/29/2016 | (5) |

|

|

|

|

| 2,513 |

| 5,027 |

| 10,054 |

| | 66,658 |

|

| | 12/1/2015 | (5) |

|

|

|

|

| 2,487 |

| 4,975 |

| 9,950 |

| | 65,969 |

|

| | 12/2/2014 | (5) |

|

|

|

|

| 2,300 |

| 4,601 |

| 9,202 |

| | 61,009 |

|

| | |

(1) | Amounts represent the range of possible cash payouts for fiscal 2017 awards under the annual cash incentive plan as described in “Compensation Discussion and Analysis — Compensation Elements — Annual Cash Incentive Awards”. The awards that were earned based on actual performance for fiscal 2017 were paid in December 2017 and are shown in the “Non-Equity Incentive Plan Compensation” column of the Summary Compensation Table.FISCAL 2022 GRANTS OF PLAN-BASED AWARDS TABLE |

| |

(2) | Represents PRSU awards that may be earned based on the achievement of performance goals in the 2017 performance period. See “Compensation Discussion and Analysis — Compensation Elements — Long-Term Equity-Based Compensation — Performance-Based Restricted Stock Units”. Estimated amounts that may be earned over the three-year award cycle of PRSUs granted for fiscal 2015, 2016 and 2017 are reflected in “Outstanding Equity Awards Table” below. |

| |

(3) | Represents time-vesting RSUs. Each RSU entitles the grantee to receive one share of Common Stock upon vesting. The RSUs generally vest in equal installments on the first, second and third anniversaries of the grant date. See “Compensation Discussion and Analysis — Compensation Elements — Long-Term Equity-Based Compensation — Time-Based Restricted Stock Units”. The RSUs granted to Mr. Hall on March 29, 2017 vest in full on January 23, 2018. See “Compensation Discussion and Analysis — Other Cash and Equity Awards” for more information. |

| |

(4) | See footnote 4 to the “Summary Compensation Table” for a description of the methods used to determine grant date fair value of equity-based awards. |

| |

(5) | Represents the range of shares of Common Stock that may vest after the end of the three-year award cycle applicable to a PRSU award solely with respect to the fiscal 2017 performance period, assuming achievement of threshold, target and maximum performance. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Estimated Possible Payouts

Under Non-Equity Incentive

Plan Awards | | Estimated Future Issuance

of Shares Under Equity

Incentive Plans | All Other

Option Awards:

Number of

Securities

Underlying

Options

(#) | Exercise or Base Price of Option Awards ($/Sh)(6) | All Other Stock-Based

Awards

(#) | Grant Date Fair Value of Stock-Based Awards ($)(7) |

| Name | Award Date | | Minimum

($) | Target

($) | Maximum

($) | | Threshold

(#) | Target

(#) | Maximum

(#) |

| J. Scott Hall | | (1) | — | | 886,438 | | 1,772,877 | | |

|

|

| | |

|

|

| 11/30/2021 | (2) | | | | | | | | | | 47,193 | | 643,713 | |

| 11/30/2021 | (3) | | | | | 47,196 | | 94,391 | | 188,782 | | | | | 1,487,602 | |

| 11/30/2021 | (4) | | | | | | | | 187,680 | | 13.64 | | | 643,742 | |

| 12/3/2019 | (5) | | | | | 12,433 | | 24,866 | | 49,732 | | | | | 339,172 | |

| Marietta Edmunds Zakas | | (1) | — | | 314,070 | | 628,141 | | |

|

|

| | |

|

|

| 11/30/2021 | (2) | | | | | | | | | | 12,015 | | 163,885 | |

| 11/30/2021 | (3) | | | | | 12,015 | | 24,030 | | 48,060 | | | | | 378,713 | |

| 11/30/2021 | (4) | | | | | | | | 47,778 | | 13.64 | | | 163,879 | |

| 12/3/2019 | (5) |

|

|

| | 3,671 | | 7,341 | | 14,682 | | | |

| 100,131 | |

| Steven S. Heinrichs | | (1) | — | | 272,515 | | 545,029 | | |

|

|

| | |

|

|

| 11/30/2021 | (2) | | | | | | | | | | 9,390 | | 128,080 | |

| 11/30/2021 | (3) | | | | | 9,393 | | 18,785 | | 37,570 | | | | | 296,052 | |

| 11/30/2021 | (4) | | | | | | | | 37,350 | | 13.64 | | 128,111 | |

| 12/3/2019 | (5) | | | | | 2,871 | | 5,742 | | 11,484 | | | | | 78,321 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Estimated Possible Payouts

Under Non-Equity Incentive

Plan Awards | | Estimated Future Issuance

of Shares Under Equity

Incentive Plans | All Other

Option Awards:

Number of

Securities

Underlying

Options

(#) | Exercise or Base Price of Option Awards ($/Sh)(6) | All Other Stock-Based

Awards

(#) | Grant Date Fair Value of Stock-Based Awards ($)(7) |

| Name | Award Date | | Minimum

($) | Target

($) | Maximum

($) | | Threshold

(#) | Target

(#) | Maximum

(#) |

| Todd P. Helms | | (1) | — | | 220,602 | | 441,204 | | | | | | | | | |

| 11/30/2021 | (2) | | | | | | | | | | 6,573 | | 89,656 | |

| 11/30/2021 | (3) | | | | | 6,575 | | 13,149 | | 26,298 | | | | | 207,228 | |

| 11/30/2021 | (4) | | | | | | | | 26,145 | | 13.64 | | 89,677 | |

| 2/24/2020 | (8) | | | | | 1,922 | | 3,844 | | 7,688 | | | | | 52,432 | |

| Kenji Takeuchi | | (1) | — | | 185,031 | | 370,061 | | | | | | | | | |

| 11/30/2021 | (2) | | | | | | | | | | 6,606 | | 90,106 | |

| 11/30/2021 | (3) | | | | | 6,607 | | 13,214 | | 26,428 | | | | | 208,253 | |

| 11/30/2021 | (4) | | | | | | | | 26,274 | | 13.64 | | 90,120 | |

| 12/3/2019 | (5) | | | | | 1,776 | | 3,552 | | 7,104 | | | | | 48,449 | |

(1)Amounts represent the range of possible cash payouts for fiscal 2022 awards under the annual cash incentive plan as described in “Compensation Discussion and Analysis — Compensation Elements — Annual Cash Incentive Awards.” The amounts that were earned based on actual performance for fiscal 2022 were paid in December 2022 and are shown in the “Non-Equity Incentive Plan Compensation” column of the Summary Compensation Table.

(2)Represents time-based RSUs. Each RSU entitles the grantee to receive one share of Common Stock upon vesting. The RSUs generally vest in equal installments on the first, second and third anniversaries of the award date. See “Compensation Discussion and Analysis — Compensation Elements — Long-Term Equity-Based Compensation — Time-Based Restricted Stock Units” for more information.

(3)Represents the range of shares of Common Stock that may vest after the end of the three-year cumulative award period applicable to a PRSU award based solely on rTSR performance goals established in fiscal 2022, i.e., Market Units, assuming achievement of threshold, target and maximum performance. The grant date fair value of the fiscal 2022 Market Units was $15.76. See “Compensation Discussion and Analysis — Compensation Elements — Long-Term Equity-Based Compensation — Performance-Based Restricted Stock Units” for more information.

(4)Represents stock options. Upon vesting, each stock option entitles the NEO to purchase one share of our common stock at a specified exercise price. These stock options vest in equal installments on the first, second and third anniversary of the date of award. Once vested, options will generally remain exercisable until their normal expiration dates, which are ten years from the grant date. Grantees generally have ninety days to exercise any vested options upon termination of employment. This period is extended to one year in the event termination results from death and disability and two years in the case of retirement. All outstanding options will immediately terminate if the grantee is terminated for cause. The grant date fair value of the fiscal 2022 stock options was $3.43.

(5)Represents the range of shares of Common Stock that may vest after the end of the three-year award cycle applicable to a PRSU award solely with respect to the fiscal 2022 RONA performance period goals established in fiscal 2022, i.e., RONA Units, assuming achievement of threshold, target and maximum performance.

(6)Each stock option granted during fiscal 2022 was granted with a per-share exercise price equal to the closing price of the underlying common stock on the New York Stock Exchange on the award date.

(7)See footnote 2 and footnote 3 to the “Summary Compensation Table” for a description of the methods used to determine grant date fair value of equity-based awards.

(8)Mr. Helms received an award commensurate with his position and in line with awards granted to the then-current senior officers of the Company at the time of his hiring. This row represents the range of shares of Common Stock that may vest after the end of the three-year award cycle applicable to a PRSU award solely with respect to the fiscal 2022 RONA performance period goals established in fiscal 2022, i.e., RONA Units, assuming achievement of threshold, target and maximum performance.

PROXY STATEMENT FOR 2023 ANNUAL MEETING 57

Outstanding Equity Awards Table